As we leave a torrid year for investing behind and start a new year, we review how different asset classes and stock markets performed in the last quarter of 2022, which funds and sectors have been the winners and losers over the past quarter, as well as which key themes are driving markets.

It is unlikely many are sad to leave 2022 behind them. While the final quarter of 2022 (Q4) gave some optimism that inflation may have peaked and recession may be shallow and short in length, it wasn’t likely enough, leaving most nursing investment losses.

Markets remained unpredictable as 2022 came to a close, but there are factors to be optimistic about. Inflation is showing signs of peaking, and the US, the world’s most strategically important economy, continues to demonstrate resilience, setting the stage for a potentially shallower recession than many have feared. While 2023 might not be the antidote to 2022, there is a glimmer of hope.

Asset classes

Quarter 4 saw markets continue to move unpredictably. At the start of the period, central banks were reporting their expectation that their respective economies were heading for recession while raising rates. They also indicated that tighter policy was to remain the priority as long as inflation remained persistently high.

A month later the bankers had shifted the dialogue over inflation and rate rises. Notably, the US Federal Reserve (FED) indicated the pace of rate rises might slow down ahead. In a report of relatively benign US inflation data, inflation slipped from 8.2% in September to 7.7% in October. This led to markets popping higher by mid-November as market participants considered whether US rate-setters and other central banks will slow the pace of rising rates ahead. The safe-haven US Dollar slipped.

Markets were given a further boost from a slight relaxation of China’s zero-tolerance Covid policy and news that authorities announced plans to alleviate the problems in the troubled property sector.

In Q4, on optimism, equities outperformed bonds. US Treasuries were the worst-performing asset class followed by commodities, global bonds and REITs. Infrastructure assets performed best over the period with equities following closely behind.

The Bloomberg Global Aggregate bond index slipped -2.98% over the quarter and -5.7% over the year.

It continued to be a challenging quarter for property and a year to forget for the asset class, returning -2.56% in Q4, returning -16.41% for the year.

Infrastructure fared better over the quarter and despite headwinds throughout the year managed to eek gains in both the quarter and for the year of 2.03% and 7.02% respectively, based on returns from the MSCI ACWI REITs index.

Gold was flat on the quarter but in sterling terms kept pace with the inflation over the year, returning 0.62% in Q4 and 11.74% in 2022, based on the spot price of the LBMA Gold Bullion Sterling/Troy Ounce index.

For context; commodities were the best-performing asset class for the year with the Bloomberg Commodity GTR Index returning 30.76%, followed by Gold and Infrastructure. There is probably no surprise that Gilts were the worst-performing asset of 2022 with the Bloomberg Sterling Gilt TR Index down -25.1% followed by REITs.

While the aggregate of global equities posted a gain of 1.86% in Q4, it wasn’t enough to get the asset class out of the quagmire it has been bogged down in through 2022, returning -7.83% based on data from the MSCI World Index.

Regions

China and emerging markets had a torrid time through 2022, with the exception of India. In China, zero-tolerance Covid lockdowns, regulatory concerns in the technology, educational, and property sectors, and rising tensions over Taiwan sovereignty have all impacted returns. Emerging markets have been impacted by a strong dollar in 2022 and disruptions to supply chains from Chinese lockdowns. However, Q4 has seen a relaxation of lockdown measures in China, and a slightly weaker dollar (a reflection of a potential slowing in US interest rate rise) has seen both China and emerging markets bounce back in Q4 returning 5.34% and 1.8% respectively. While they remain lower for the year at -12.09%% and -10.02% respectively.

India has been a relative bright spot in emerging markets throughout 2022. Buoyed by cheap Russian energy imports supporting strong economic growth. This has seen the MSCI India Index rise 3.64% for the year. However, it was the worst-performing region of those reviewed during the quarter, down by -5.36% due to persistent concerns over global inflation.

Europe was down -7.62% for the year. A strong recovery in Q4 saw the MSCI Europe ex UK Index rise 11.46%, the best performer over the period. The strong performance has been due to risk appetite returning over the quarter, some stabilisation in energy costs, inflation looking as though it may have peaked and China reducing its lockdown restrictions.

While the UK has been tarnished as a basket case after the Kwasi Kwarteng mini-budget in September and the continued challenges of Brexit, the region still managed to eek out a positive performance for the year, surpassing Europe and the US returning 1.92%. It was also the second-best regional performer in Q4, behind Europe, returning 9.39%.

TILLIT Universe

The UK and European markets have been particularly impacted by rising energy and food costs, as well as supply chain disruption caused by the Chinese lockdown. Europe and the UK have been pricing in gloomy valuation, yet the energy crisis is not proving to be as bad as predicted. And with Europe, the consensus underweight for the majority of the year, and UK fund managers highlighting UK equities are at fairly depressed valuations with attractive dividends, it might not have been too surprising to some that any let-up in the economic outlook could bode well for them.

European and UK equities were the best performing regions in Q4. While they were the best performers over the period they have been shunned by investors through 2022 for the reasons mentioned. Over the course of the year, small caps in these regions have been hard hit as they tend to be skewed towards domestic cyclical companies.

The outlier to this has been UK large-cap stocks that have broken even on the year, supported by a small number of large companies associated with commodities.

It seems investors have been taking advantage of the depressed valuations in small and mid-cap, which fund managers have been keen to highlight. They are seeking to exploit what they believe to be mispricing of mid and small-caps. This is shown in our top-performing funds as LF Montanaro European Smaller Companies Trust, Aberforth Smaller Companies Trust, Montanaro UK Income, and Premier Miton European Opportunities, which are either small-cap focused or have a mid and small-cap bias.

Silver prices have been on a tear since the November low. Silver is often considered in the same breath as gold and sits comfortably under the precious metal banner. However, it has many more industrial uses than gold, it tends to be more volatile and more affordable. Like gold, silver is often considered a shield against market turmoil and a store of value. Silver often outperforms gold in such periods.

Given the year that was 2022, it is probably no surprise that Silver rose 15.51% over the year and 17.54% in Q4, in Sterling terms according to the S&P GSCI Silver Spot index. The Invesco Physical Silver ETC rose 16.1% over the period and is benchmarked against the LBMA Silver PR US index.

Biotech funds were among the best performers in Q3 but had a tougher time in Q4.The Biotech Growth Trust returned -6.8%. After strong gains made in Q3, US drug pricing concerns and investor concerns over other higher growth areas of the market continued to concern investors it seems. The Biotech Growth Trust has a bias toward small caps unlike The AXA Framlington Biotech fund, which returned -1.8% for the period. For additional context, MSCI ACWI Small Caps were up 2.5% in Q4.

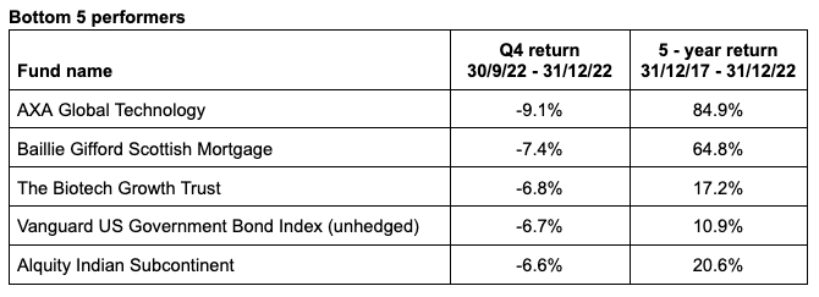

The worst hit sectors in Q4 were UK Direct Property, India and Technology some way behind, returning -7.14%, -7.08, and -3.98% respectively, based on Investment Association Sector performance data. AXA Global Technology was the worst-performing fund on the TILLIT Universe during the period, returning -9.1%. While there is a wide spread between the sector return and the AXA Global Technology fund, it is worth noting that the Technology sector the fund is measured against consists of a broad range of strategies across the market cap spectrum. Additionally, the size of the AXA fund makes it hard for the manager to own near the market weight of some of the mega caps in the index.

While Baillie Gifford Scottish Mortgage is not a technology fund it has a combined exposure of technology and biotech companies of c.44%. Baillie Gifford Scottish Mortgage ended the period down -7.4%, while the discount on the investment trust narrowed from -12.4% on the 30th September 2022 to -8.6% on the 30th December 2022.

It has been a terrible year for bonds. Normally considered ‘steady Eddies’ bonds have been volatile through 2022. Bonds rebounded in October and November, however by December prices started retreating once more as investors digested stronger-than-expected US economic data and China opening up from its Covid lockdown restrictions.

Investors in the Vanguard US Government Bond Index (unhedged) class were hardest hit experiencing returns of -6.7%. While investors who have hedged would have had a return of 0.22%. Over the period Sterling was up against the US Dollar by 8.5%.

India was the worst-performing region in Q4 returning -5.36%. Alquity Indian Subcontinent underperformed the MSCI India TR index, returning -6.6%. While the Alquity Indian Subcontinent doesn’t subscribe to a benchmark, given its strong Environmental, Social, and Governance (ESG) constraints and thematic approach to investing in the region, considering it against a broad index, such as the MSCI India TR index provides some relative context to performance.

Looking ahead

Central Banks have been open that their actions taken on interest rate rises in 2022 are likely to lead to a recession. And while a recession is expected, its length and depth can not be anticipated with any degree of accuracy.

Other challenges in 2023 may come in the form of lower dividend growth, due to the rising cost of capital and the complexities of inventory build-up, recessionary pressure, and high inflation, despite strong balance sheets and cash flow.

A reacceleration of inflation, central banks taking the monetary tightening cycle too far, and Russia turning up the geopolitical dial on Ukraine shouldn’t be overlooked.

All is not terrible. There are some bright spots on the horizon that could provide some longer-term opportunities.

While earnings are under pressure equity markets are pegging their prices at historically low levels assuming economic conditions remain challenging. This is certainly the case when we look at UK valuations, however, some parts of the US market seem still optimistically priced.

The factory to the world, China has been lifting strict Covid lockdown rules, which should be supportive of improving strained supply chains, giving a boost to growth, and be supportive of moderating inflation.

Inflation has been exhibiting signs of tentative moderation, which could see interest rate rises start to slow and potentially fizzle out in the second half of 2023.

The US is the most strategically important economy in the world and the flow of dollars is a key element of what happens elsewhere. For now, the US has demonstrated resilience and looks in reasonable shape. With inflation looking like it may have peaked, this mix could bode well for a shallow, short recession.

With reasons to be optimistic, given the inflation and interest rate backdrop, it seems unlikely that we are headed back to the types of capital returns investors have enjoyed since the great financial crisis. If 2022 has taught us anything, it has shown investors need to be more considered in their investment strategies.

Sources: FE Analytics (quarterly performance figures for funds, regions, asset classes, and sectors 30/09/22 to 31/12/22). Qualitative commentary from TILLIT meetings with fund managers.

https://www.reuters.com/markets/us/us-consumer-prices-increase-less-than-expected-october-2022-11-10/

https://www.marketwatch.com/market-data?mod=currencies-market-data

https://uk.investing.com/economic-calendar/

https://www.bailliegifford.com/en/uk/intermediaries/funds/scottish-mortgage-investment-trust/

https://www.exchangerates.org.uk/GBP-USD-spot-exchange-rates-history-2022.html

Date of publication: 24 January 2023

The information in this post is not financial advice, it is provided solely to help you make your own investment decisions. If you are unsure about whether an investment is appropriate for you, please seek professional financial advice. You can find more information here.

When you invest you should remember that the value of investments, and the income from them, can go down as well as up and that past performance is no guarantee of future return.